By James Walker

Texas Southmost College

As income tax season approaches, many are hurriedly gathering their required documents and preparing to file their returns. Yet, for specific individuals, the cost of using a professional tax service can be so prohibitive that it offsets the potential refund they might receive.

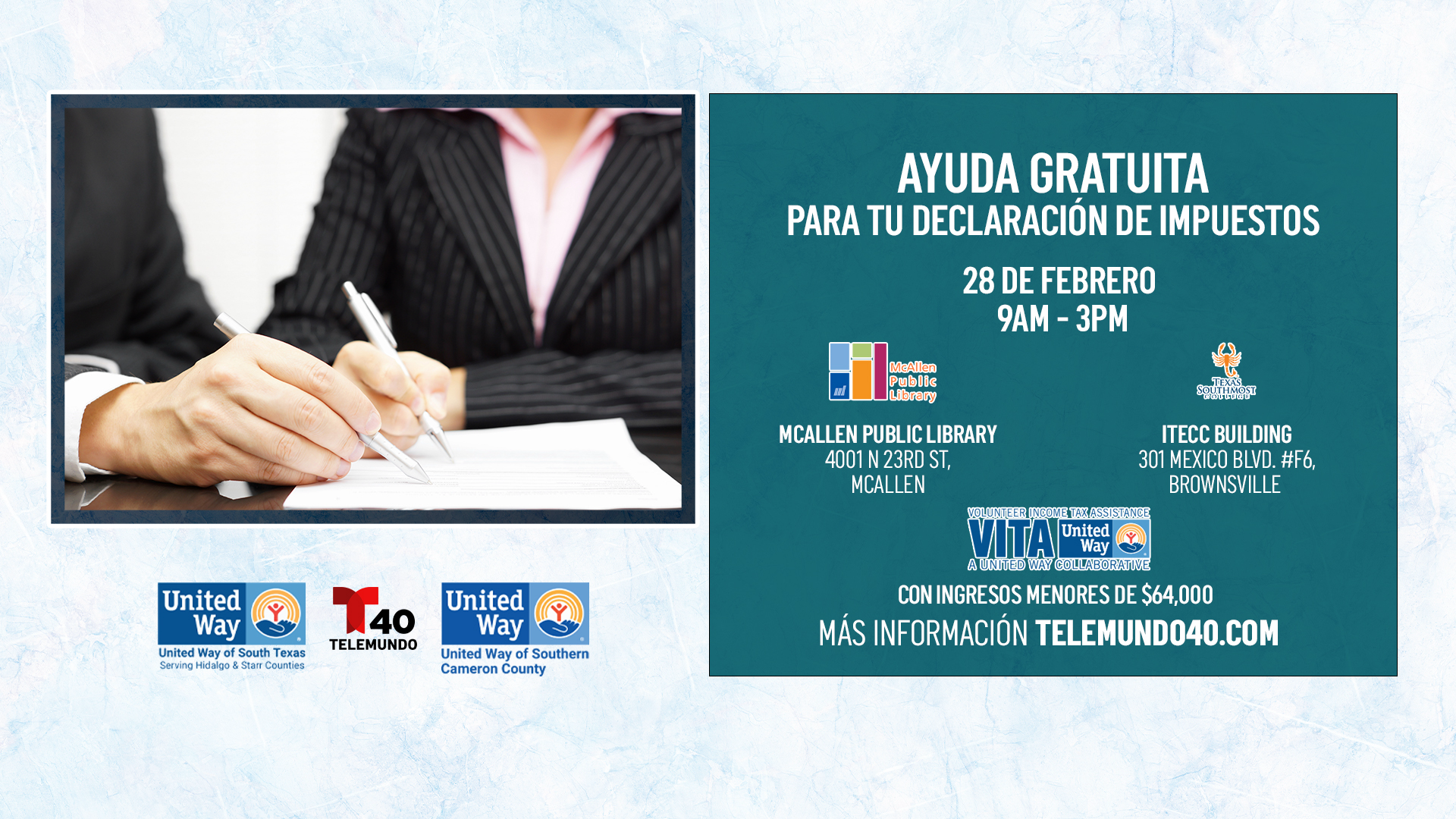

Thankfully, Texas Southmost College (TSC) partnered with the United Way of Southern Cameron County to host the VITA (Volunteer Income Tax Assistance) program throughout the tax season.

Between January 24 and April 17, volunteers from the community and students enrolled in TSC’s Accounting Technology program will be available at TSC’s International Technology, Education, and Commerce Center (ITECC) campus to assist individuals earning $64,000 or less annually.

A significant element contributing to the enduring success of the partnership is the unwavering support from Maggie Solis, the Director and instructor of TSC’s Accounting Technology Program. With twenty-two years of dedicated assistance, her commitment has played a pivotal role in the partnership’s longevity and prosperity.

Solis, who was awarded a certification of recognition by the U.S. Internal Revenue Service (IRS) in 2023 for her dedicated service to the community, feels that the VITA program is mutually beneficial to all parties involved.

“VITA is a win-win for both Accounting Technology students and the community,” said Solis. “As we all know, the cost of living has drastically increased, so having this service available for free is a great benefit to many families,” remarked Solis.

Solis also emphasizes that volunteers assist the community by IRS guidelines. “The TSC VITA site operates through quality site requirements dictated by the IRS, and all volunteer tax preparers are certified,” she stated.

Volunteers assist individuals in identifying tax credits, such as Earned Income Credit Tax and the Child Tax Credit. Additionally, as an IRS-certified site, TSC VITA volunteers can assist community members filing with an Individual Taxpayer Identification Number (ITIN).

To utilize the VITA program, individuals must schedule an appointment by dialing 956-295-3761. Once the appointment is confirmed, they should proceed to TSC’s ITECC Campus located at 301 Mexico Blvd at the designated appointment time, ensuring they bring along:

- Valid photo identification

- Original Social Security Cards for all household members

- A copy of last year’s tax return (if available)

- Health Insurance Forms 1095-A (if receiving insurance through the Market Place)

- Income documents such as Forms W-2, W-2G, and 1099 from all employers and their sources (Social Security, unemployment, pension, etc.)

- Interest and dividend statements from banks (Forms 1099)

- Bank Routing Numbers and Account Numbers for Direct Deposit of refund

- For students with post-secondary tuition expenses or grant income: Form 1098-T

- Total paid for daycare provider and the provider’s tax ID number.

- Identity Theft prevention pin (if assigned by the IRS)

- All other information pertinent to income tax filing

Both spouses must be present to sign the required forms for Married Filing Jointly (VITA sites do not prepare Married Filing Separate returns)

TSC Volunteer Income Tax Assistance

Texas Southmost College (TSC) partnered with the United Way of Southern Cameron County to host the VITA (Volunteer Income Tax Assistance) program throughout the tax season.

TSC Volunteer Income Tax Assistance

Between January 24 and April 17, volunteers from the community and students enrolled in TSC’s Accounting Technology program will be available at TSC’s International Technology, Education, and Commerce Center (ITECC) campus to assist individuals earning $64,000 or less annually.

TSC Volunteer Income Tax Assistance

For assistance, you must schedule an appointment by dialing 956-295-3761.